How to Build Credit as a Single Mom on a Budget

In a perfect world, we’d all be taught how to build credit at an early age, so we can be prepared for the future. For many of us, that’s not the case and, through a series of financial missteps, we end up requiring credit repair before the building process can begin.

If you’re a single parent on a tight budget, this entire ordeal can be even more daunting. However, you don’t need to feel overwhelmed or resigned to a long history of bad credit.

With a little discipline and the right knowledge, you can get back on track to an excellent credit score. This post has been sponsored by Lexington Law Firm, but everything in this blog is based on my thoughts and opinions. This is not financial advice. I am simply sharing tips I’ve learned along the way.

How to Build Credit – Tips for Single Parents

Strong Foundation

When it comes to building anything, you should start with a strong foundation. First, if there are negative marks on your credit report you don’t recognize or don’t believe are yours, focus on getting those resolved.

If you don’t know where to start, head over to Lexington Law Firm, and they’ll assist you through the entire process. For an affordable monthly fee, you’ll have a team working on your behalf to clean up your report.

Figure Out Your Budget

Let’s begin with any credit card debt you’ve accumulated, which is often the most frightening to get a handle on. Always try to pay more than the minimum amounts to get out from under high-interest rates quicker.

If eligible, you might want to consider transferring balances to cards with zero interest promotions. I found myself in $20,000 credit card debt, alone, and opted to take this route.

I was able to transfer several thousand to cards with no interest, then structured a plan to pay them off before the promotional period expired–I had 12 months on one and 18 months on another.

This plan requires discipline, so make sure you stay organized and NEVER make a late payment.

Once you determine your budget, stick to it. It takes discipline, and you need your family on board.

My kids know we won’t be eating out, except for special occasions. We do weekly grocery shopping (at multiple stores to get the best prices on every item) and prepare almost all meals at home.

The kids feel empowered because they know we’re working as a team. They’re older now and understand that my credit card debt provided them opportunities that I wouldn’t have been able to afford otherwise.

My son is a black belt in Tae kwon do, and it was worth every cent–including the interest–to make that happen for his physical and mental well-being. It taught him discipline during a time it was needed most.

To keep your team motivated, consider printing visual updates of your progress. I keep a spreadsheet of all running debt, and every couple of months, the kids and I review it together.

It’s incredible to see the debt we owe getting smaller and our savings getting bigger.

Don’t Forget to SAVE

While getting out of debt is important, saving money is just as vital. Even if it’s only ten dollars a week, make sure you’re putting something into savings.

Use Your Credit Cards

Once your debt is under control, try to use your credit cards often. Get cards with a points program that make the most sense for your lifestyle.

If you love to travel, get a card that offers bonus airline miles or hotel stays. Do your research carefully because, in some cases, airline and hotel programs work collaboratively.

If you love to shop at Old Navy, get their card and receive “Bucks Back.” If you’re spending money, you should absolutely be getting rewards!

During our recent back-to-school clothes shopping, we had had over $100 in credit at Old Navy because I use their card and maximize points every chance I get.

Pay off your credit cards every month to avoid paying interest. If your budget is planned, use your credit cards for purchases that you know you can pay in full. This way, you’ll get the points, too.

Again, I can’t stress enough to never make a late payment on any of your monthly bills. Paying on time is the easiest way to build your credit score.

Don’t Abuse Spending Limits

Your ratio of debt to credit available is a huge factor when determining your credit score. Having a good amount of available credit shows that you’re not going to spend it just because you can.

I have a card with a $10,000 limit and I never owe more than a couple hundred dollars–and they keep automatically raising my limit!

It’s awesome to know that credit’s available if I ever need it. If my planning works out, I’ll be able to use that when I can pay it off in full and get maximum awards benefits!

If you’re in a situation where you don’t have any credit cards and your credit score is low, start small.

You might be able to get a card with a low limit and high interest. Use it and pay it off every month to avoid that high fee.

Regular use of that card and timely payments will put your credit journey back on track. You’ll be rewarded for your good behavior with a higher score and increased spending limits.

However, it’s important that you pay all your debts consistently and on time–not just credit cards. Rents, mortgages, insurance, cell phone bills, utilities, and all services need to be paid on time to avoid marks on your credit report.

We all have those moments of forgetfulness, resulting in a late payment. If it happens to you, call the company immediately. They’ll usually wave late penalties if you’re not habitually late with payments.

Stay Organized

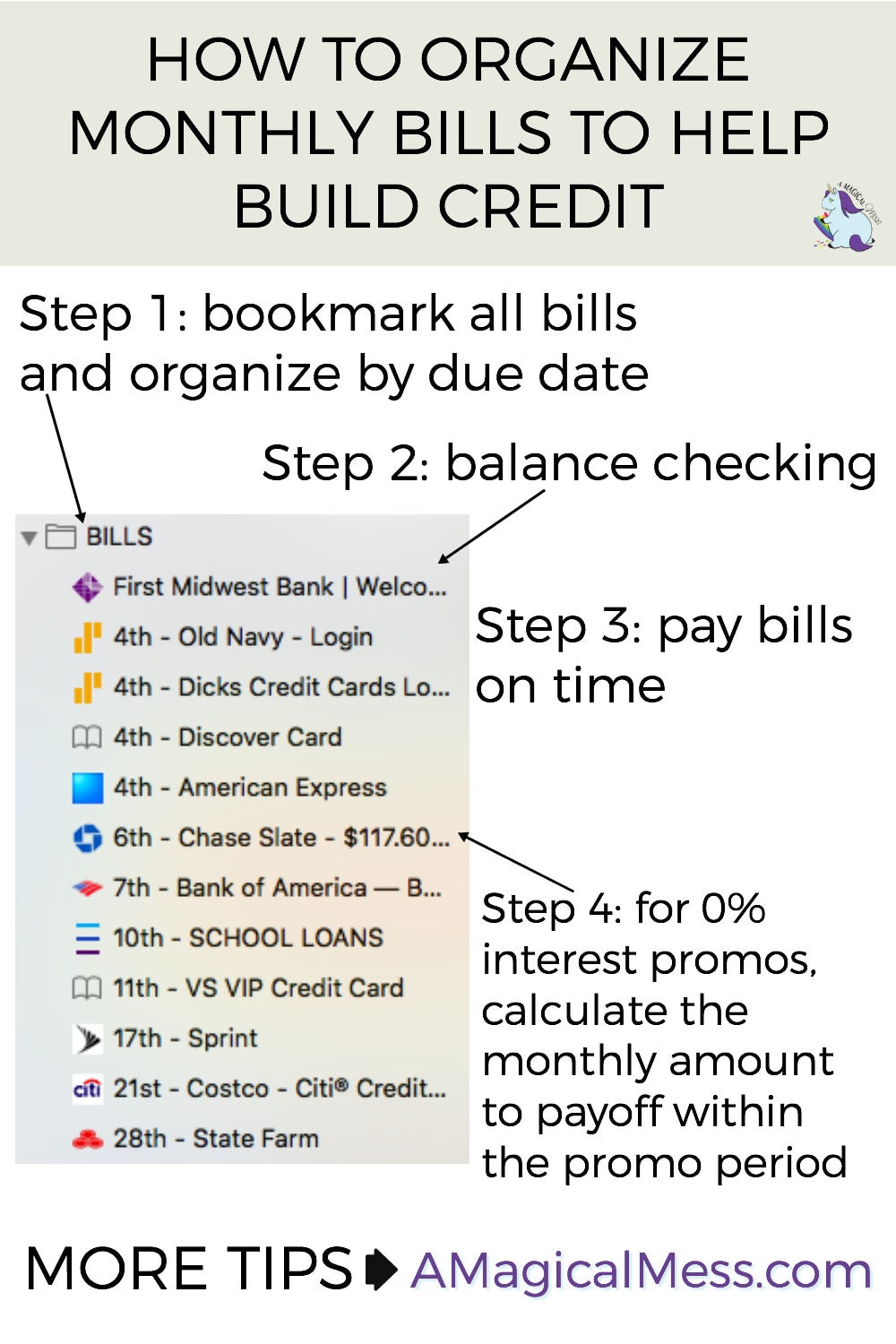

I pay all my bills online. This is a recent development because I had become so accustomed to writing checks, I found it difficult to make the switch.

I now arrange bookmarks in my browser that lead to every account I have to pay. I title the bookmark with the date the payment is due, so I can run down the list quickly and efficiently.

I’ll be totally honest here, as a single parent on a budget, I don’t always have what I need in my checking account for the whole month and have to get creative.

Sometimes I pay minimums; sometimes I pay my phone bill with a credit card to just buy some time.

However, I ALWAYS pay on time and make up the shortcoming by paying more than the minimums whenever possible.

Balance Your Checkbook

However you need to learn, do it. Balancing your checkbook will save you so much money and help build credit.

Overdraft fees are easily avoidable if you keep up with how much you have in your account.

With mobile apps, this is easier than ever, but if you’re using your debit card without considering your balance, you’re creating complications.

I avoid using debit and only use credit cards. With education and discipline, it’s how I was able to build excellent credit.

Wherever you are on the journey, it’s never too late to recover.

Super advice for all. I do like to read about organizing tips too!