Managing Money After Marriage

Money can be a difficult subject at any time, but after marriage it becomes even trickier. Combining assets and bills can put a lot of stress on newlyweds.

There are many questions to answer after the big day… Should we have kids? Where do we want to live? What is the best way to manage our finances? None of them are usually that easy to answer.

Managing Money After Marriage

Of course, everyone’s journey is different. Mike and I met in our late twenties. We both had already started our lives as independent adults. Each of us owned our own homes and other “things”, and we were both pretty set in our ways.

I think part of the attraction was that we both had our “stuff together” when we first met. However, as the relationship progressed, decisions had to be made. Mike gave up his condo to move in with me.

We wanted to build a place of our own, but the economy just wasn’t going to allow that. Being the manly man that he is I think that was a little hard on him.

It’s bred into him to be the provider, so living in a home that’s technically owned by me seemed to be an adjustment. Plus, then came the beginning of money issues… more bills to pay and how to divvy them up.

There are also new expenses to consider once you get married. We started looking into cheap term life insurance now that building a family is on the table. It’s important to protect your family financially early on, so it’s still affordable to do so.

After we got married (yes, we lived together first… no judging) then the real money talk began. I became determined to establish some sort of savings for us as a couple.

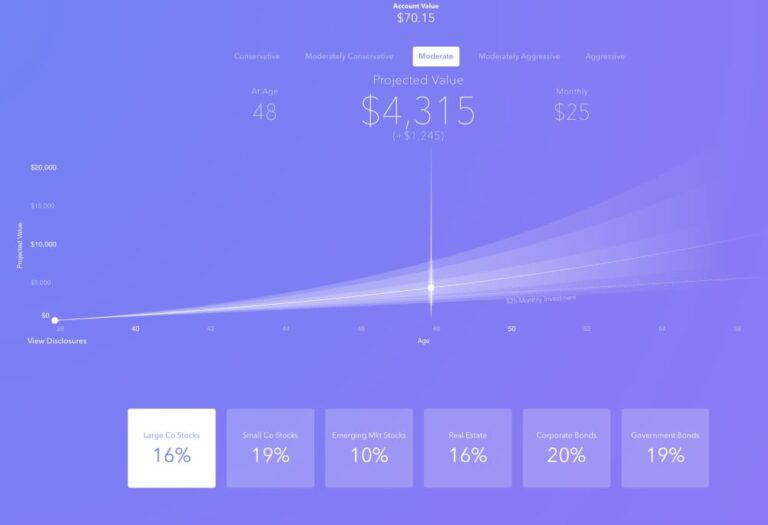

My goal was to create a retirement account, but I wanted to at least start off with a savings account. While reading about tips for planning your retirement, the sooner you start the better. There are also helpful companies, like Genworth Financial to look to for guidance.

We had never had a joint-anything, so again, another adjustment. Much discussion led us to agree that we should still maintain our own accounts, and add an additional joint-savings account.

This account would be reserved for household improvements, emergencies, and things like that. Depositing into that account is another story… it doesn’t happen that often!

Keeping our own separate checking accounts has prevented a lot of money arguments. Neither one of us makes a lot of money, but we are still a two-income household and we pay our bills on time.

He has an agreed upon amount that he is to give me every month. I then make the monthly payments towards most of the bills.

As long as he gives me that amount, we are good. I don’t complain when he comes home with yet another fishing…whatever! And ditto for me and my gadgets!

So, my advice to any couple who is marrying for love (LOL) would be to devise a plan before you get hitched. Every situation is different, but remember that marriage should be a partnership.

Try to get a plan into action so you can enjoy each other as much as possible after the wedding.

Do you have any money-managing tips for newlyweds? I would love to hear them in the comments below.

When Hubz and I married we had each been used to keeping or own homes and paying our own bills. For the first few months we each tried to take charge of things. We ended up paying some bills twice and not paying others at all! We obviously had to get a grip. We decided that one of should do the paying and keeping up with things. So we both get the bills in our emails and we have joint accounts–we pay almost everything online–but the actual paying is done by Hubz. I take a certain amount each week to buy what we need for the household and put in savings–the less I spend, the more we save. After all that, if we end up with anything extra in regular checking after a few weeks, part of that amount goes into savings, too. This way, one does the bills, one does the household, and there are two ways that money goes into savings. This is what works for us. There are as many ways to do things as there are couples 🙂

Sounds like you ended up with quite a good setup! It definitely takes some adjusting. Hubs and I have been married for a year and 1/2 now and we are still figuring it out. It’s not rocket science, but for some reason it can be confusing! 😉

My husband and I had our own “stuff” too – since marrying nearly 8 years ago quite a bit has changed. We went from a two-income couple, to a one-income family of three. Having said that, adjusting to one-income has been a challenge, but we’re managing. I pay all of the bills using an automatic bill pay feature and it works great. I love that we don’t have to think about paying something, it does it “by itself”. That’s made things so much easier in terms of managing the money and my time.

We contribute to a 401(k) through my husband’s employer, and my 401(k) was rolled over to an IRA when I decided to stop working. We now contribute to the IRA as well. I feel like we could be saving more, but we need to live life, too!

401(k) is a great option. I wish our jobs offered that. Mike does have a pension and annuity from his union, so that’s good. Personally I have ZERO retirement money. If we ever have kids I would definitely want to be home with them. Going to one income would be horrifying though!

Money is such a hot button issue for people that I agree it needs to be discussed before marriage. It can get touchy if you don’t.

John and I have had a joint account since our 2nd year of dating. We use that as the bills/mortgage account and each put in the same amount monthly to cover the bills & mortgage. After that account we have separate accounts but I manage both. He’s not “good” with managing and I’m fine with it so it works out for us both.

I used to have a 401(k) but I cashed it out to pay the closing costs for our first home. My husband has a 401(k) now and as great as it is that he has one, I really want to open one up again! Since I work from home, I don’t have access to a plan, so I opened a payroll account for my blogging business so that I can eventually save up enough to open my own plan!

I’m not married yet – But the Mister and I have been together for over 7 years now. With a kid, a dog, and a house together. Hopefully I get to put these tips to use soon…. I’m not getting any younger here, lol.

I think the hardest thing about marriage is dealing with finances, especially if one is a spender and the other is frugal.

Definitely! My hubby is the spender for sure. I am more worried about saving.

Learn to set a budget, but leave room in it for some fun. Being newlyweds is easier if you get to go out together and enjoy your time off!

I took care of making sure all the bills were paid on time for 30 years of our marriage. Then I had a bad brain enuryism and was in icu 21 days and then rehab. It took a year to get some of my lost memory back. My husband had no idea how to take care of the bills while I was sick. He worried and was afraid he would forget one. I wish I had showed him how I did them before I got sick.

I have two pieces of advise. First off, make sure both people know what bills need paid and all the necessary websites, passwords, etc. Login info should be kept in a secure place.

Also, make sure both people have established credit on their own. It’s very important so that things like credit cards AMD mortgages can transfer successfully when the need arises. Make an effort to keep up the established credit.

don’t open alot of credit cards from different companies…they are to easy to use !

My husband and I are very careful with our finances! Especially in todays economy. We budget together and every 6 months we go over EVERYTHING! Retirement funds, 401k, and our checking/savings. I pay ALL the bills however my husband is fully capable of paying them as well 🙂

My husband and I are so lucky to be on the same page when it comes to finances. Neither of us believe in buying things on credit, which has made a big difference for us.

Thanks for the information.

I def agree on separate accounts!!!! But paying the bills together!

You should really discuss most of this before you get married. Knowing how you are going to divide duties of money management helps to stop a lot of fighting.

Glad things are working out for you. Thanks for sharing!

Thanks for sharing information. Finances are a touchy issue for all of us.